Guest Article By Marc Derendinger

“Key Finding: Sutter/PAMF wants you to enroll in Medicare Advantage plans, and is turning away new patients on traditional (original) Medicare Parts A and B (including those covered by supplemental medigap insurance)”

(This story has been updated) The popular neighborhood social platform, Nextdoor, has been buzzing with stories of Palo Alto Medical Foundation (Sutter Health) limiting access to doctors for some Medicare beneficiaries. Nextdoor is a social platform that connects neighbors.

What happened?

PAMF offices are reportedly saying its doctors will not accept new patients who are on original Medicare Part A and B. When pressed for details, one PAMF employee explained this policy is really not new, and has been in effect since January 2021.

Will This Be A New Trend for Medical Groups? -See our Commentary about the need to solidify doctor relationships before turning 65, as well as recent market disruption in Northern California for beneficiaries using Medicare at Stanford and Sutter Health

When pushed for details, the representative messaged a supervisor who confirmed the new rules and further explained “existing patients” are those who have been seen by their physician within the last three years.

This raises a serious question: when your physician retires from the medical group, does this downgrade your status to “new patient?”

What doctors are saying…

Through chance, I met up with a PAMF physician earlier this summer who commented on a June 2021 staff meeting: “Doctors were told they could no longer accept new Medicare patients, effective immediately.” The reason cited was the amount of money Sutter/PAMF was losing on original Medicare patients (which was probably exacerbated by reduced procedures/visits during the pandemic).

The Sacramento Business Journal has also reported, March 4th 2021, on pending Sutter Health changes due to pandemic related losses. Are these new access restrictions related?

>>>>>>>This story was updated on October 1st:

- For readers interested in Stanford Healthcare – Stanford Hospital

- For readers interested in Sutter Health or Palo Alto Medical Foundation

- What one San Jose Broker says will happen by January 1, 2025

What professional insurance brokers are saying…

Conferring with local independent insurance agents who specialize in Medicare, the talk is how CMS (Medicare) has been applying pressure on Sutter Health in recent years, to shift more of their patients to Medicare Advantage Plans. Why? Agents say with these types of plans Medicare costs are lower and more predictable, and coverage is often better. “A win-win” situation, some say.

Story Update 9/1/2021: PAMF Clarification

Speaking with a PAMF employee on September 1st who described her position as “patient onboarding,” the employee clarified that Medicare patients, new to PAMF, will have access to some physicians via Medicare Advantage plans, but not via traditional Medicare Supplement plans (e.g. medigap Plan G, Plan F etc.).

What does this really mean? PAMF appears to be saying patients with original Medicare coverage will continue to have access to their physicians at Palo Alto Medical Foundation. However, new patients will have to enroll with one of the Medicare Advantage plans that have contracted with Sutter Health/PAMF or go elsewhere to obtain medical services.

“Established patients with original Medicare coverage will continue to have access to their physicians at Palo Alto Medical Foundation. However, new patients will have to enroll with one of the Medicare Advantage plans that have contracted with Sutter Health/PAMF or go elsewhere to obtain medical services.”

What is Medicare Advantage? According to the National Medicare Handbook, published by the Centers for Medicare and Medicaid Services (CMS), titled Medicare and You 2022:

Medicare Advantage (also known as Part C)

- Medicare Advantage is an “all in one” alternative to Original Medicare. These ““bundled” plans include Part A, Part B, and usually Part D.

- Plans may have lower out-of-pocket costs than Original Medicare (see related story on supplemental insurance for original Medicare).

[Marc: the “lower costs” claim has been widely debated, but a recent Kaiser Family Foundation (KFF) issue brief lends evidence to the claim].

- In many cases, you’ll need to use doctors who are in the plan’s network.

[Marc: network limitation is not a big deal for individuals who only utilize PAMF doctors, but if you have doctors outside of PAMF, you may wish to consider plans that allow more flexibility e.g. original medicare or Medicare Advantage PPO plans (there a a few, but not as many as Medicare Advantage HMO plans).]

- Most plans offer extra benefits that Original Medicare doesn’t cover—like vision, hearing, dental, and more.

The trend is up for Medicare Advantage plans. As of 2021, KFF reported “more than 26 million people are enrolled in a Medicare Advantage plan, accounting for 42 percent of the total Medicare population”

However, despite all the positive press, there are risks to consider; Medicare Advantage may not be for everyone.

Risks Factors of Enrolling in Medicare Advantage

CMS publications cite many positive attributes of Medicare Advantage plans, but to be fair, there are also risks: I have talked with Medicare beneficiaries who did not properly understand these risks at time of enrollment, and I wish to share some of their experiences:

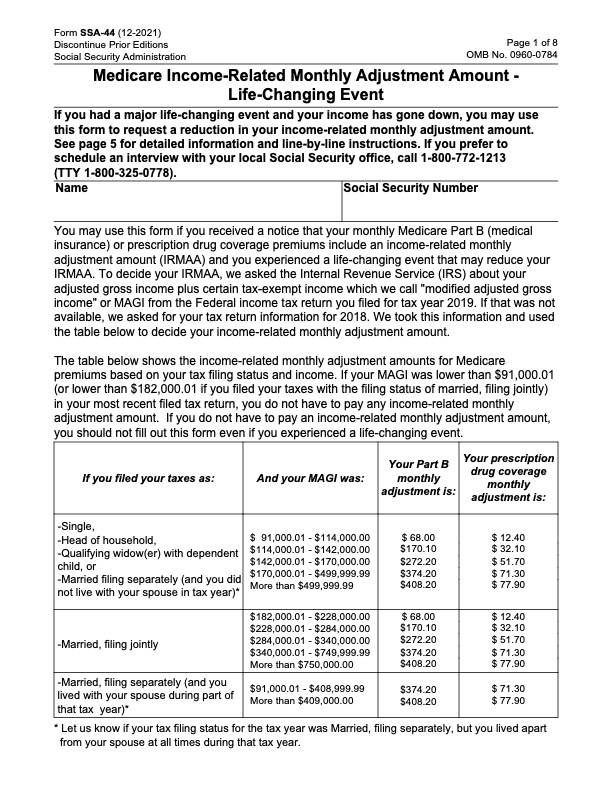

- Risk #1: You enroll in a Medicare Advantage plan for the first time, but later change your mind and wish to go back to original (traditional) Medicare with supplemental (medigap) insurance.

This is perhaps the biggest issue I come across. While Medicare rules provide multiple opportunities to disenroll and return to original Part A and Part B, they do NOT provide as much protection on your right to re-enroll in Medicare Supplement (medigap) insurance e.g. Plan G, Plan F etc.

Why this matters: supplemental Medigap insurance matters immensely, because Medicare alone limits hospital coverage via deductibles, copayments and total number of days lifetime. Further, Part B only pays 80% (you are responsible for the remaining 20% coinsurance) for Part B expenses. Let me emphasize there is no out of pocket maximum limit on the 20%. Consider that Chemotherapy expenses usually fall under Part B and you start to realize the size of this financial liability. Once this has been explained, no rational person would take on this risk without medigap insurance, especially given the low premium cost for such insurance e.g. under $150 per month for those turning 65 (see self-insure article).

Trial Rights

I would be remiss if I did not talk about trial rights i.e. Medicare Guarantee Issue protections. However, they do not go far enough: Let me share a phone call last October from an individual with Stage 4 Cancer wishing to disenroll from Medicare Advantage after just 3 years (age 68).

Why did he want to leave his Medicare Advantage plan? He wanted access to a Cancer treatment center that he heard was accepting original Medicare, but the center was not affiliated with his Medicare Advantage plan.

Technically, he could disenroll and go back to original Medicare, but….he could not buy supplemental medigap insurance unless he could provide evidence of insurability to the insurance company. Sadly and reluctantly, he remained with his Medicare Advantage plan.

The “Trial Right” (return to medigap insurance) protections are complex and even the initial 12 month trial right does not apply in all situations. I strongly urge readers to find a competent independent agent to explain these rules before enrolling in a Medicare Advantage plan for the first time. The more “independent” and the more “local,” the better. This subject is too important to take a chance on.

The Cost of Using Agents

Many readers wonder if there is an extra (embedded) cost to working with independent agents. The answer is no, and the premiums are the same. The benefit to you is local agents already know which Medicare Advantage plans are contracted with Sutter/PAMF- it has always amazed me why anybody would invite sales calls from 3 different insurance company representatives when one independent agent can impartially explain all three? Note: You can also find local agents using the United Healthcare Local Agent Finder tool. Besides, a local independent agent will stay with you for years, to advise if better plans become available in the future. Recommendation: Engage with an agent by Age 62, to help you understand and prepare for Medicare. But if you really don’t want to talk to an agent, just go to CaliforniaEnrollment.Com

Practice due diligence and don’t ever allow yourself “to be sold.”

Marc Derendinger is an independent insurance agent in Santa Clara County, with 30 years experience with Medicare health plans and related insurance programs. He helped set-up the City of San Jose’s first ever group long-term care insurance program in 2001, benefiting their 9,000+ employees and retirees. He is licensed by the California Department of Insurance, license no. 0644617, and can be contacted at 408-252-7300. www.derendingerins.com.