Marc’s Plain Talk and Important Questions about Medigap insurance Why don’t online quotation services talk about premium costs in year 2, year 3 or 5? (only the first year, which is skewed with heavy, temporary discounting) Are all medigap plans the same? If so, why do premiums vary so dramatically from company to company? Do […]

Retiring and Making the Switch To Medicare Are you preparing to retire and leave your employer-sponsored health insurance and make the switch to Medicare? This transition can be daunting, but understanding the steps involved can make the process smoother. Here’s a comprehensive checklist to guide you through retiring and enrolling in Medicare. 1. Don’t Rush […]

Navigating Medicare with Stanford or Sutter/PAMF Accessing Stanford or Sutter/Palo Alto Medical Foundation (PAMF) with your Medicare has become progressively more challenging in recent years. However, it’s not impossible. Schedule your Free 15-minute Telephone Consult Gone are the days of purchasing a Medicare policy and keeping it forever. The dynamic Medicare market in the Bay […]

Get Prepared for Part B It is time to think about leaving your employer insurance for Medicare and to Apply for Medicare Part B. The purpose of this article is to help you prepare for Medicare, in advance, and to avoid missing important deadlines, which could lead to missed opportunities or even extra costs. Bookmark this […]

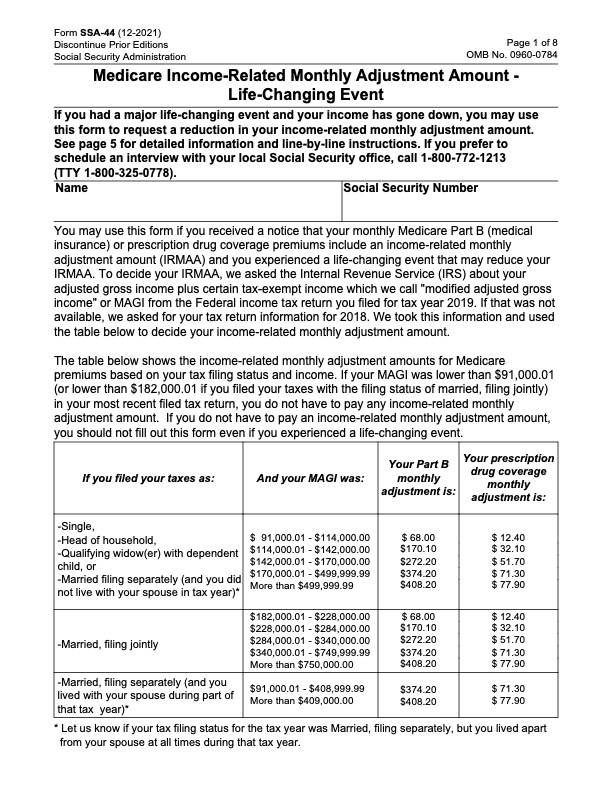

Under normal circumstances, you may Apply for Medicare Part A and even Part B (only) at a local Social Security Administration office. Since appointments are limited, consider applying online: You can apply for Part A and Part B at ssa.gov/benefits/medicare and until recently, via telephone appointment: In some situations, it may still be possible to schedule […]

Calendly Topic: “How To Select a Medigap Plan” What does Medicare cover? Learn how to make a smart decision when it comes time to sign up for Medicare Supplement Insurance i.e. the best practices of How To Select A Medigap Plan. We are an independent agency , authorized to offer AARP branded United Healthcare, Blue […]

Medigap Supplement Plan G FAQs Navigating the world of Medigap plans can be overwhelming, especially with 25 Medigap Plan G choices in the San Jose – Mountain View region alone. Plus a recent, major Plan Closure. How does one determine which is the best choice for your situation? To help, we’ve compiled the top 5 […]

Is Blue Shield and Blue Cross the Same? Blue Shield of California is not the same as Anthem Blue Cross. In fact, their Medicare Supplement (aka “medigap”) products compete directly against one another. By most estimates, Blue Shield of California is the market share leader for the number of medigap (medicare supplement) insurance policies issued […]

Choosing The Best Medigap Plan G What’s all the Buzz about Plan G and its “medigap cousin,” Plan G Extra? For persons turning 65 on or after January 1, 2020, Plan G replaces the hugely popular Plan F. Early feedback is Plan G is just as popular as before, and now, in 2024 there are […]