What Every 62 year-old should know… before reaching 63. [Yet, only 5 out of 100 actually do.]

For most self-employed individuals (and many W-2 employees), age 62 is your final opportunity to adopt strategies to avoid paying too much to the government, when you eventually apply to Medicare three years later.

Ironically, most self-employed and 1099 employees cannot wait for the opportunity to apply for Medicare Parts A and B…because health insurance premiums drop to under $150 per month (in the San Jose bay area) and the Part B deductible is an unbelievably low $226 per year.

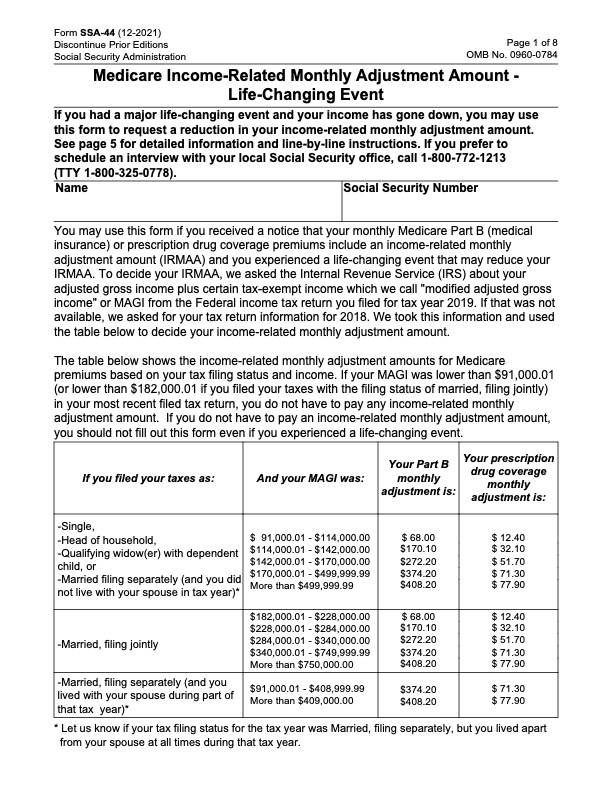

But there’s a problem for many, because at the time you apply for Medicare Part B, usually at age 65, you may discover too late, that Medicare adjusts your payment higher for Part B, when your income rises above a certain threshold.

Specifically, Medicare looks at your Federal Income tax return to determine if your payment for Part B (benchmarked at $164.90/mo in 2023) should be adjusted higher and in some cases, a lot higher. It surprises many that Medicare does not look at current income, rather they look at your tax return from two years prior.

We found over 90% of 62 year-olds are unaware of their opportunities to mitigate these extra costs. Furthermore, it only compounds the problem to blindly create capital gains through stock sales or Roth conversions, a common practice in preparation for retirement.

These are very important issues. You can get more information on this topic when you Subscribe (FREE) to this newsletter. It is focused solely on San Jose and the surrounding Bay Area.